Go Public? Go Crypto? Go Nav.

NAV is a strategy and execution firm focused on transforming crypto and public companies into market-ready leaders. We operate at the intersection of digital assets and traditional finance.

Three Pillars of Execution

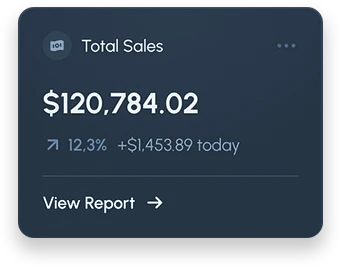

BTC Treasury Strategy

SPAC Structuring & Public Listings

Legal & Market Compliance

Your Project. Public-Ready in Three Steps.

A proven framework to turn your private project into a public company.

Project Evaluation

-

Entity and jurisdictional review

-

Team and governance analysis

-

Financial model stress-testing

-

Token or equity structure audit

-

Regulatory exposure and risk assessment

BTC Treasury & Financial Strategy

-

Treasury architecture (BTC or hybrid)

-

Token-economic alignment (if applicable)

-

Cap table optimization

-

Financial restructuring and reserve planning

-

Investor optics and capitalization narratives

SPAC Execution

-

SPAC sponsor matching and deal structuring

-

Term sheet design and capital allocation

-

SEC-compliant documentation and disclosures

-

Financial audits and legal diligence

-

Exchange preparation and investor materials

BTC Treasury & Financial Strategy

-

Treasury architecture (BTC or hybrid)

-

Token-economic alignment (if applicable)

-

Cap table optimization

-

Financial restructuring and reserve planning

-

Investor optics and capitalization narratives

NAV specializes in corporate transformations with a dual focus:

We help crypto companies go public—through SPACs, reverse mergers, or uplistings—with integrated treasury strategies designed to attract institutional capital.

We also work with dormant or declining public companies that need a credible entry into the crypto space. This can involve Bitcoin treasury strategies, tokenization of assets, or pivoting the business model toward digital infrastructure.

We don’t offer services. We deliver transactions, public market strategies, and permanent positioning.

About NavMarkets

Built for Execution

Built for Execution

SPAC & Public Market Architects

Decades of experience structuring and listing companies on NASDAQ, ADGM, and other global exchanges.

Regulatory & Legal Engineers

Specialists in multi-jurisdictional compliance, token law, and Bitcoin treasury disclosures.

Crypto-Native Builders

Founders and advisors of leading token ecosystems, DeFi platforms, and exchange-listed projects.

Sovereign Finance Advisors

Deep relationships across the Gulf, Latin America, and Eastern Europe—backed by experience crafting state-level economic reform, sovereign investment programs, and asset tokenization strategies.

Media & Narrative Strategists

Experts in building attention-based capital systems through targeted campaigns, influencer alliances, and economic storytelling.

We take projects public.

Execution is our product.

navigating markets

Our Team.

Our Vision.

The NAV Approach

Discovery & Evaluation

Financial Architecture & BTC Strategy

SPAC Structuring & Market Preparation

Listing Execution & Post-Market Support

Help center

Got a Question?

Get your Answer.

Frequently Asked Questions

1. What types of projects does NAVMarkets work with?

2. Do you only work with crypto companies?

3. How long does the process take?

4. Do you raise capital for projects?

5. What is a Bitcoin treasury strategy, and why does it matter?